Newest releases...

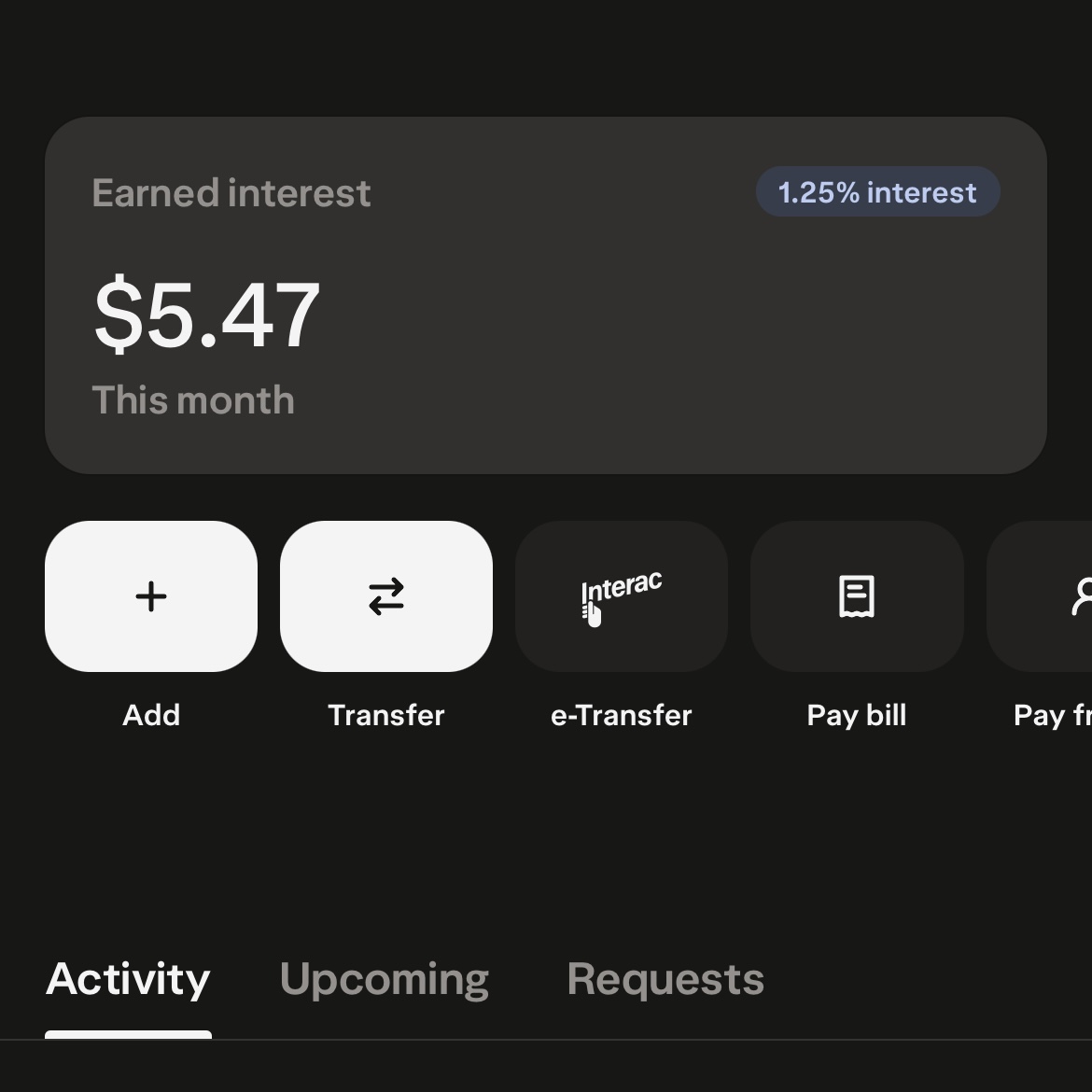

Earned Interest Calculator for Wealthsimple

This tool calculates the interest earned based on your Wealthsimple chequing account balance and account tier. It's great for people considering opening a Wealthsimple chequing account or moving funds into one.

Interest Calculator

Balance:

$

Base rate:

%

Direct deposit:

Account status:

Results

Rate:

1.25%

Daily interest:

$0.00

7-day interest:

$0.00

30-day interest:

$0.00

Yearly interest (compounded monthly):

$0.00

Examples

Scenario 1:

You have a balance of $3,000 and do not have direct deposit set up for your paycheque from work. Your combined assets in all accounts with Wealthsimple total to $4,678.

...

To calculate the interest, we first need to find the rate you will get. Since your total assets are under $100,000 your account has Core status, meaning you will only get the base interest rate. If direct deposit was set up you would get a 0.5% boost, but in this scenario it is not set up.

1.25% (base) + 0% (status) + 0% (direct deposit) = 1.25%

With our interest rate defined, we convert it to a decimal.

1.25% = 0.0125

Next we divide the interest rate by 365 (days in a year), then multiply by your account balance. This will give us the daily interest earned.

0.0125 / 365 x 3000 = $0.10

...

This means we will earn $0.10 in interest every single day we maintain a balance of $3,000 in our Wealthsimple Chequing account.

Scenario 2:

You have a balance of $125,000 and have direct deposit set up for your eligible greater-than-$2000 paycheque from work. Your combined assets in all accounts with Wealthsimple total to $134,009.

...

To calculate the interest, we first need to find the rate you will get. Since your total assets are over $100,000 but under $500,000 your account has Premium status, meaning you will get the base interest rate plus 0.5%. Since direct deposit of an eligible paycheque over $2,000 is set up, you get an additional 0.5% boost.

1.25% (base) + 0.5% (status) + 0.5% (direct deposit) = 2.25%

With our interest rate defined, we convert it to a decimal.

2.25% = 0.0225

Next we divide the interest rate by 365 (days in a year), then multiply by your account balance. This will give us the daily interest earned.

0.0225 / 365 x 125000 = $7.71

...

This means we will earn $7.71 in interest every single day we maintain a balance of $125,000 in our Wealthsimple Chequing account.

Scenario 3:

You have a balance of $675,000 and have direct deposit set up for your eligible greater-than-$2000 paycheque from work. Your combined assets in all accounts with Wealthsimple total to $1,090,650.

...

To calculate the interest, we first need to find the rate you will get. Since your total assets are over $500,000 your account has Generation status, meaning you will get the base interest rate plus 1%. Since direct deposit of an eligible paycheque over $2,000 is set up, you would normally get a boost, but because you have already gotten the maximum interest rate of 2.25%, direct deposit does not apply in this case.

1.25% (base) + 1% (status) + 0% (direct deposit) = 2.25%

With our interest rate defined, we convert it to a decimal.

2.25% = 0.0225

Next we divide the interest rate by 365 (days in a year), then multiply by your account balance. This will give us the daily interest earned.

0.0225 / 365 x 675000 = $41.61

...

This means we will earn $41.61 in interest every single day we maintain a balance of $675,000 in our Wealthsimple Chequing account.

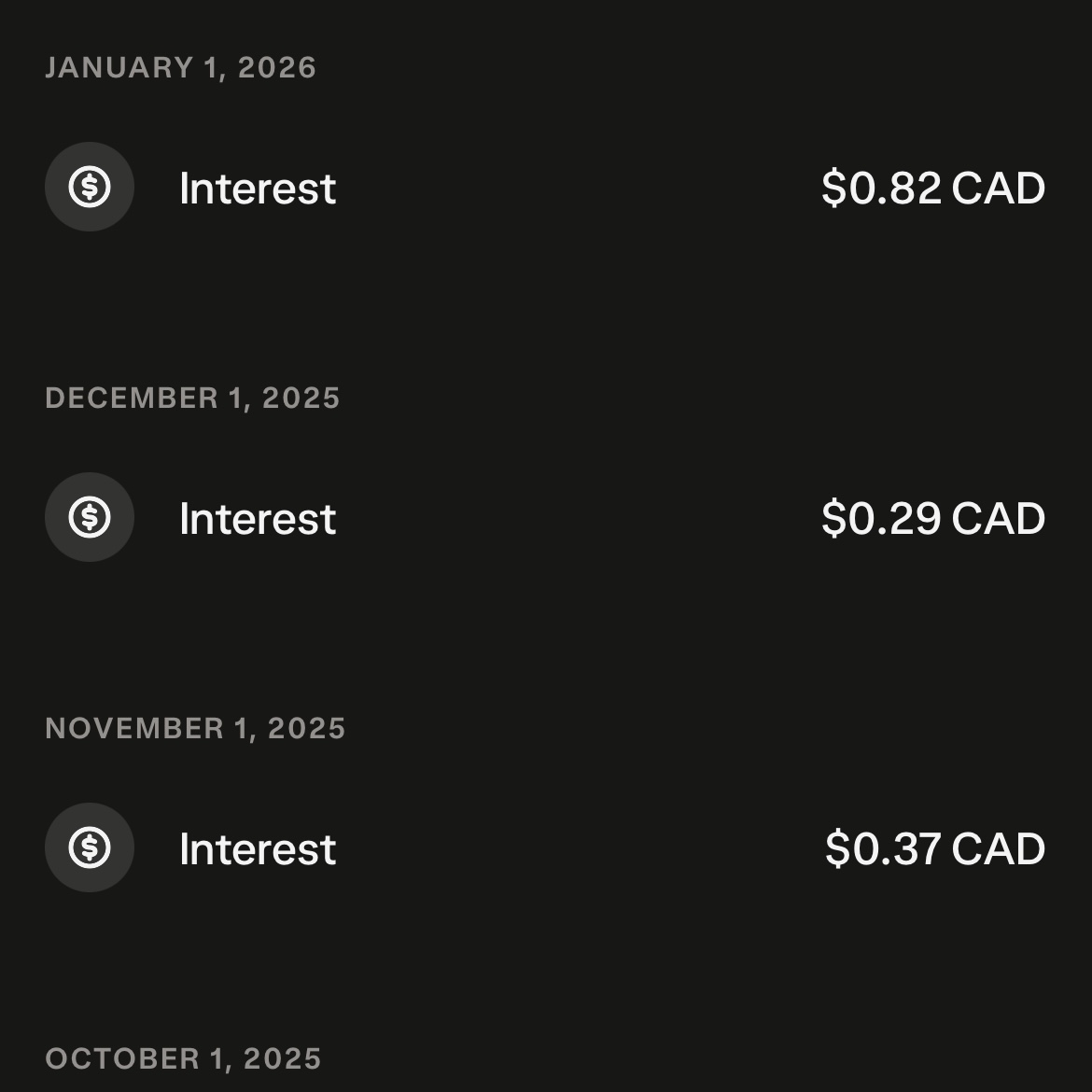

Extra Photos

FAQs

Will the interest rate ever change?

Yes, the interest rate usually changes whenever the Bank of Canada key interest rate changes, as the two are closely linked. The Bank of Canada revises its key interest rate eight times per year. It might go up, down or stay the same, just depends on the Bank of Canada's assessment of the economy at each time. Wealthsimple usually sends out an email before they adjust their rate, and in it they explain why the rate is changing.

Is the interest earned taxable?

Yes it is taxable. Speak to your accountant or tax preparer for more details on your specific situation.

What is the difference between Core, Premium and Generation status?

Core is the lowest of the three account statuses, and has the lowest interest rate on chequing accounts. If you have less than $100,000 of assets across your Wealthsimple accounts, you have Core status. Premium status is awarded when you have between $100,000 and $500,000 in assets with Wealthsimple. You get a slightly better interest rate in addition to a few extra perks. If you have over $500,000 in assets with Wealthsimple, your account will have Generation status. This is the highest of the statuses, and gives you the best interest rate (usually level with the BoC key rate) in addition to premium support, lower fees, and even more bonus perks.

Common pitfalls to avoid

Avoid...

Opening a Wealthsimple account if you won't be living in Canada

Because...

They cannot service non-residents

Further explained...

Wealthsimple requires account holders to inform them if they are no longer residing in Canada, because Wealthsimple may be required to close the account due to non-residency. So if you plan on leaving Canada to permanently live elsewhere, avoid opening a Wealthsimple account, or makes plans in advance to transfer your assets to a different institution if you already have one because it will be a much smoother transition than Wealthsimple flagging your account for non-residency once you've logged in from a foreign country too many times.

When this calculator can't help you...

Calculating returns on stocks and bonds, as well as cashback with your Wealthsimple credit card are entirely separate topics unrelated to chequing account interest, therefore this calculator will not be useful in those instances, as it has been specifically designed only to calculate the Wealthsimple-paid interest on chequing accounts. If you have a specific idea for a calculator that would be useful, you can always reach out via our contact form to see if it's something we can make!

Related pages

Data sources

0.5% Interest Rate Boost with Direct Deposits – Wealthsimple Promotions

Author: Wealthsimple

Publisher: Wealthsimple

Published: N/A

Accessed: 18 Jan. 2026

Learn about the Wealthsimple chequing account interest rate – Help Centre

Author: Wealthsimple

Publisher: Wealthsimple

Published: 15 Dec. 2025

Accessed: 18 Jan. 2026

Accessing your Wealthsimple app and accounts while travelling – Help Centre

Author: Wealthsimple

Publisher: Wealthsimple

Published: 17 Nov. 2025

Accessed: 24 Jan. 2026